RAM SUSTAINABILITY: UEM GROUP’S SUSTAINABILITY SUKUK FRAMEWORK ENABLES GREEN FINANCING FOR NATIONAL DECARBONISATION PROJECTS AND INVESTMENTS

RAM Sustainability has completed the external review (also known as a second opinion) of UEM Group Berhad’s (UEM) Sustainability Sukuk Framework (the Framework) and concluded that it meets recognised green finance standards.

UEM is a wholly owned subsidiary of Khazanah Nasional Berhad (Khazanah) with interests in expressways, township and property development, engineering and construction, asset and facility management, and green industries. Khazanah, Malaysia’s sovereign wealth fund, the champion of a large-scale integrated Renewable Energy Zone under the National Energy Transition Roadmap (NETR), has identified UEM as its green investment vehicle.

RAM Sustainability opines that the green initiatives to be financed under the Framework for renewable energy, energy efficiency, clean transportation, and pollution prevention and control has the potential to contribute towards national decarbonisation targets as defined in the NETR and the 12th Malaysia Plan.

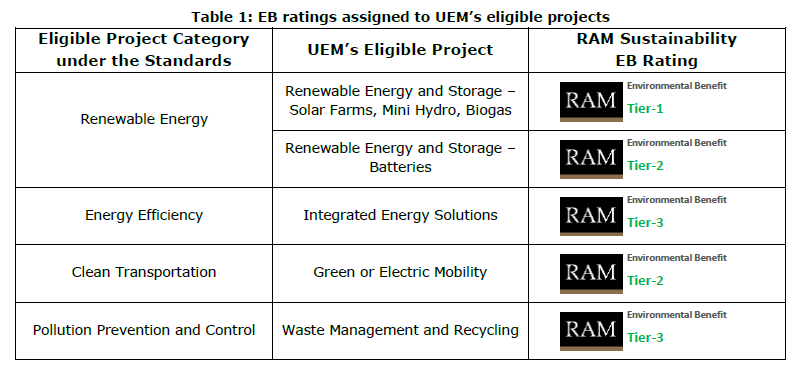

We have assigned the highest Tier-1 Environmental Benefit (EB) rating to the respective renewable energy eligible projects for solar, hydropower and biogas, reflecting their potential contribution towards significant climate and wider environmental benefits. EB ratings for other eligible projects under the Framework range from Tier-2 to Tier-3 (see Table 1).

RAM Sustainability also concludes that the Framework is aligned with the disclosure requirements of the SRI Sukuk Framework, ASEAN Green Bond Standards, and Green Bond Standards. The Framework is aligned with all core areas, and 10 out of 20 recommendations in the pre-issuance checklist of the Green Bond Principles.

At this juncture, RAM Sustainability’s review is limited to the green bond and sukuk perspectives as the current Framework has yet to exhibit social projects or sustainability-linked components. UEM plans to update the Framework in the future with more eligible projects and sustainability-linked components.

Back to Media Centre